Federal Budget Announcement 2021-22: What you Need to Know

Treasurer Josh Frydenberg has announced the 2021/2022 Federal Budget. Below is a summary of the key financial implications and what you need to know for businesses and individuals following the Federal Budget. Business financial implications The temporary full expensing scheme has been extended until the end of the 2022/2023 financial year. It had been scheduled […]

Webinar Video: 2020-21 Federal Budget

Directors, Nick Pateras and Chris Wilson, hosted a webinar on the ‘2020-21 Federal Budget‘. This webinar covered: How much of a Personal Tax Cut will you be getting? As a business what does the ‘Instant Asset Write-Off’ mean and what is its value? The Loss Carry Back. If you have business losses how can I use these […]

Federal Budget 2018 Recap

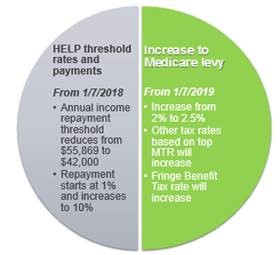

The measures in the budget have a positive vibe about them – e.g. tax cuts for individuals, additional support for small business investment, helping retirees build their superannuation and the Medicare Levy remaining at 2% and changes that target taxpayers who are not doing the right thing by their employees. In hindsight there were […]

2017 Federal Budget

First home savers, downsizers and small business are winners in Treasurer Scott Morrison’s second Budget – while taxpayers face an increase in the Medicare levy. It’s been a relatively quiet year given last year’s substantial Superannuation changes. However, there are some measures in the 2017 Federal Budget that could have an effect on many […]