Tax Planning: Opportunities To Save Tax With Super Contributions

Tax Deduction Opportunities with Super Contributions There are some excellent tax benefits you can gain by making voluntary superannuation contributions. Generally, money invested in super is taxed at a lower rate than your personal income tax rate. How Concessional Contributions are Taxed Concessional (before tax) super contributions include employer super contributions made on your behalf, […]

Additional Tax on SMSFs with Balances Over $3 Million

The federal government has recently announced an increase to the tax rate for individuals who have superannuation balances over $3 million. In this article we cover the short and long-term implications for self-managed super funds (SMSFs). How much is the tax rate increasing? The tax rate on super fund contributions and earnings for people with […]

Key SMSF Changes in 2022

The tax and superannuation laws are always changing, and we are here to help you stay informed. As a Trustee / Director of a Trustee Company for your Self Managed Superannuation Fund (SMSF), you need to be aware of key changes each year and opportunities and risk areas. We have outlined the 2022 key areas […]

1 July 2022 and Superannuation Contribution Changes

What are the changes? Originally announced in the 2021 Federal Budget, the following changes apply from 1 July 2022: Individuals up to the age of 74, will no longer need to meet a work test to make voluntary, non-deductible, contributions Individuals up to the age of 75, with a total super balance under $1.7 million, […]

Top 5 Reasons To Have An SMSF

Self-managed super funds (SMSFs) are becoming increasingly popular in Australia due to the greater degree of control and flexibility they provide. More than 1 million Australians are now SMSF members. Having your own self-managed super fund allows you to have full control over the assets you invest in for your retirement. You can develop your […]

Making a Downsizer Contribution to Super

Since 1 July 2018, eligible Australians over 65 who sell their homes can make a one-off contribution of the sales proceeds into super. This is known as a ‘downsizer’ contribution and the amount cannot exceed $300,000. Eligibility requirements In addition to being aged over 65, the other downsizer contribution eligibility requirements are: You (and/or your […]

How To Choose Right Super Investment Option

If there’s one thing certain in life, it’s change. And generally, your perspective towards saving and investing will change as you get older. The way your super is invested at the beginning of your career may not be the most suitable approach when you’re closer to retirement. Fortunately, you can change your investment options at […]

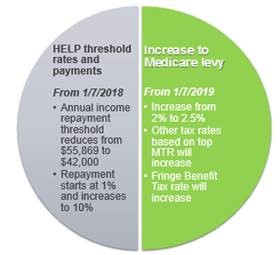

2017 Federal Budget

First home savers, downsizers and small business are winners in Treasurer Scott Morrison’s second Budget – while taxpayers face an increase in the Medicare levy. It’s been a relatively quiet year given last year’s substantial Superannuation changes. However, there are some measures in the 2017 Federal Budget that could have an effect on many […]

Super Changes

THE BIGGEST SUPER CHANGES EVER – ACT NOW! Major changes to tax and superannuation were approved by the Government in early December 2016. These are the biggest changes in the last 10 years – they are significant changes and will affect how your own superannuation is taxed now and in the future. The start date […]