Urgent for Trusts: Avoid extra tax with a Trust Distribution Resolution before 30 June 2024

All Trust Distribution Resolutions need to be completed before 30 June to avoid paying extra tax of up to 47% of Trust profits.

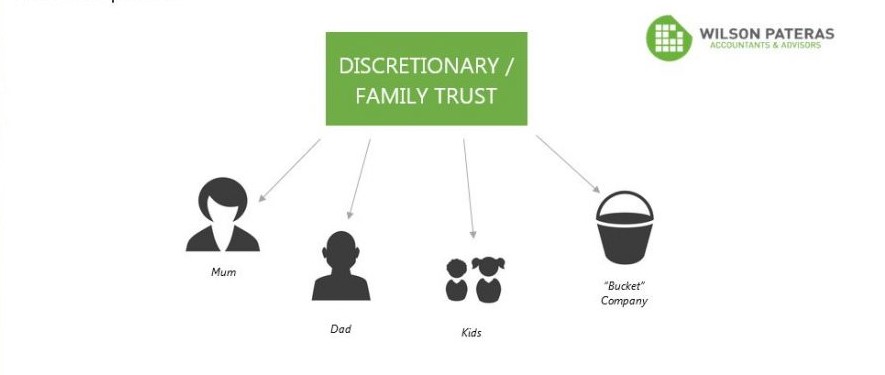

If a Trustee of a Trust fails to make a resolution to distribute the income of the Trust before the end of the financial year, the Trustee may be assessed by the Australian Taxation Office (ATO) on the Trust income at the highest marginal tax rate of 47%, rather than the intended beneficiaries being taxed at generally much lower tax rates.

What we can do to help you

We can review your Trust Deed to identify if you need to consider varying your Trust Deed to remove certain beneficiaries and therefore remove the risk of them forcing the Trustee to pay Trust profits to them.

We can then prepare your 2024 Trust Distribution Resolution for any Discretionary Trusts or Family Trusts that you have. You need to sign these before 30 June or the ATO may tax your Trust at the highest rate of 47% on any trust profits.

As part of our service, we will send you Payment Instructions for each Trust beneficiary to sign. This new document for 2024 is needed to prove to the ATO that your Trust’s payments to beneficiaries are not part of what S100A of the tax legislation calls a “reimbursement agreement”, resulting in tax of 47% being assessed on these Trust distributions.

The steps we can undertake on your behalf include:

- Review of your prior year Trust Distribution Resolution

- Confirmation with you of the estimated Trust income of your Trust for the year ended 30 June 2024

- Review of your Trust Deed to ensure that the income definition and distribution clauses in your Trust Deed allow the proposed Trust Distribution Resolution for 30 June 2024

- Advice on the most tax effective distribution of this estimated Trust income

- Preparation of Trust Distribution Resolution and ensuring it is signed by the Trustees PRIOR to 30 June 2024

Please contact us to book your tax planning consultation on (03) 8419 9800.

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.