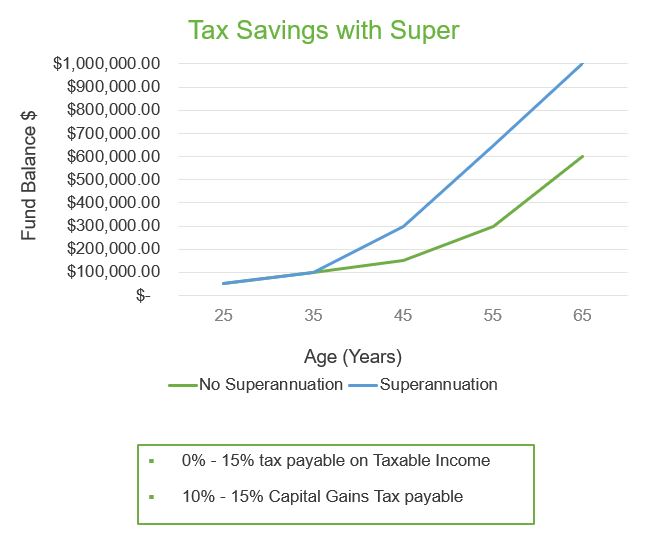

One effective tax planning strategy is to maximise your superannuation contributions. Superannuation contributions can offer significant tax benefits, as they are taxed at a lower rate than your marginal tax rate. By making additional concessional (before-tax) contributions, you can reduce your taxable income, potentially lowering your overall tax liability.

For the 2023-24 financial year, the annual concessional contributions cap is $27,500 per year. Additionally, you can make non-concessional (after-tax) contributions of up to $110,000, which can help increase your retirement savings.

From July 1, 2024, the contribution limits for superannuation will increase from $27,500 to $30,000 for concessional super contributions and from $110,000 to $120,000 for non-concessional contributions.

In this article, we will explore some advanced superannuation strategies that can help you optimise your retirement savings and potentially reduce your tax, including:

- Carry forward unused concessional contributions

- “Double dip” contributions

- Using the bring forward rule

- Downsizer contributions

- Starting a pension in your super fund

- Buying a property in your super

- Franking credit refunds

- Capital gains in super

These strategies require careful planning and consideration. It is important to review your individual circumstances and seek advice from a financial advisor to determine the most suitable strategy for you.

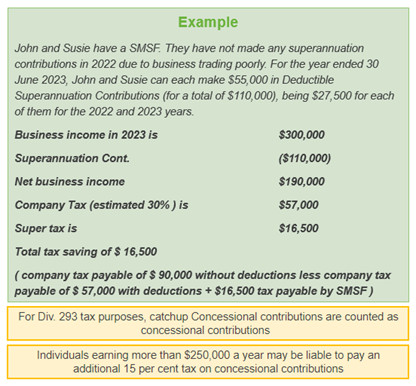

Carry Forward Unused Concessional Contributions

If eligible, you can make more than $27,500 (annual concessional contribution cap) of deductible contributions in a superfund; that way you can save tax by claiming deductions under other entities. You can carry forward unused concessional contributions for up to five years.

This year presents a unique opportunity as it is the final year to make additional super contributions and claim additional tax savings for the 2019 financial year!

Below is an example for carry forward unused concessional contributions:

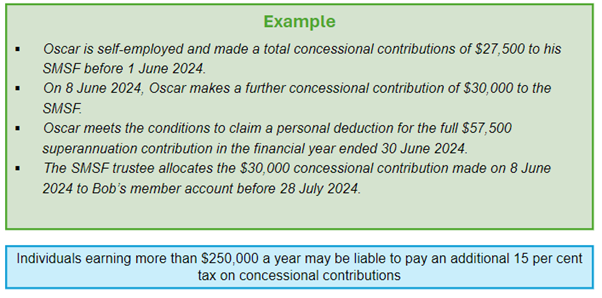

SMSF Contributions Reserving Strategy (Double-Dip)

“Double-dip” contributions in a Self-Managed Super Fund (SMSF) refers to a strategy where an individual makes personal after-tax contributions to their SMSF and then claims a tax deduction for those contributions. This strategy allows the individual to effectively “double-dip” by benefiting from both the concessional tax treatment of contributions and the tax deduction.

Here is how the double-dip contributions strategy works

- Make After-Tax Contributions: The individual makes personal after-tax contributions to their SMSF. These contributions are taxed when they are made to the fund.

- Claim a Tax Deduction: The individual then claims a tax deduction for these contributions in their personal tax return. This deduction reduces their taxable income, potentially resulting in a lower tax liability.

- Notification Requirement: To claim a tax deduction for personal contributions to an SMSF, the individual must notify the fund in writing of their intention to claim a deduction and receive an acknowledgment from the fund.

Eligibility

- You are able to “prepay” contributions

- The additional contributions must be paid in June.

Using the Bring Forward Rule

The ‘bring forward rule’ allows you to bring forward up to two years’ worth of future non-concessional contributions into the current year, provided your total superannuation balance allows it and you are under 75 years old.

If you use the bring forward rule before June 30, 2024, the maximum contribution allowed is $330,000. However, if you delay this until July 1, 2024, or later, the maximum contribution allowed under this rule increases to $360,000.

Downsizer Contributions

Downsizer contributions allows you to sell your home and put extra money (up to $300,000 per member) into your superannuation. If eligible, you can make up to $300,000 of tax-free contributions even if you are above 75 years and regardless of the after tax contribution caps. .

Start a Pension in your Superannuation Fund

Starting a pension in your superannuation fund can offer several tax-saving benefits. Once you start a pension, the earnings on the investments supporting your pension are tax-free. Additionally, if you are aged 60 or over, the pension payments you receive are tax-free.

Eligibility (you need to meet only one of the following)

- You have reached preservation age and you are permanently retired

- You are 60 years old, and ceased a role of employment/business

- You are 65 years old

Pension Considerations

- Tax rate for amount in pension is 0% – tax friendly environment

- Minimum pension payment each year must be made

- Can start if met a “Condition of Release”, mentioned above

Compared to not starting a Pension

- Tax rate is 15% for income and 10% for capital gains

- No requirement to take money out of super

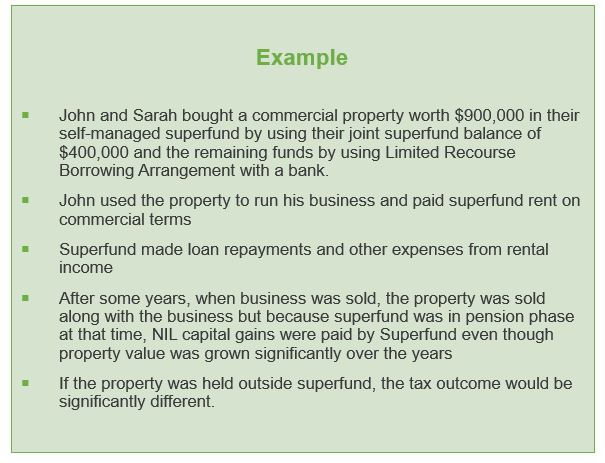

Buying a Property in Superannuation

Buying a property in a Self-Managed Super Fund (SMSF) can be tax-effective due to concessional tax rates for income and capital gains, deductions for property-related expenses, and potential capital gains tax exemptions. However, strict regulations apply; such as the sole purpose test and contributions are subject to caps.

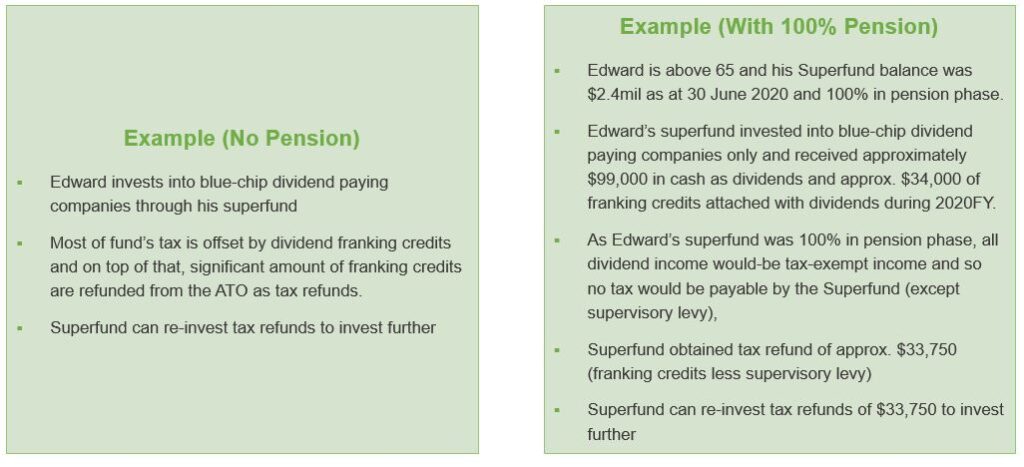

Franking Credit Refunds

Complying superfunds pays maximum tax of 15% on fund’s taxable income and because fully franked dividends have tax credits of higher than 15%, excess tax credits can be received as tax refunds.

When an SMSF receives dividends from Australian shares, it may also receive franking credits (also known as imputation credits) attached to those dividends. These franking credits represent tax that the company has already paid on its profits.

If the SMSF’s taxable income is less than the franking credits it has received, it may be entitled to a refund of the excess franking credits. This can effectively reduce the tax payable by the SMSF or result in a tax refund.

To benefit from franking credit refunds, SMSFs can consider investing in Australian shares that pay fully franked dividends. This strategy can be particularly beneficial for SMSFs with members in a lower tax bracket or in pension phase, as they may be eligible for a refund of franking credits.

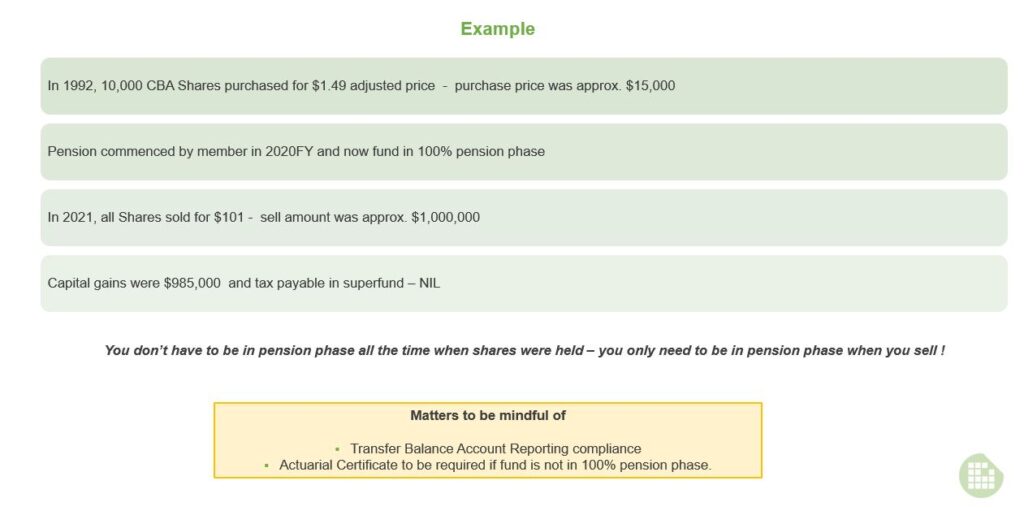

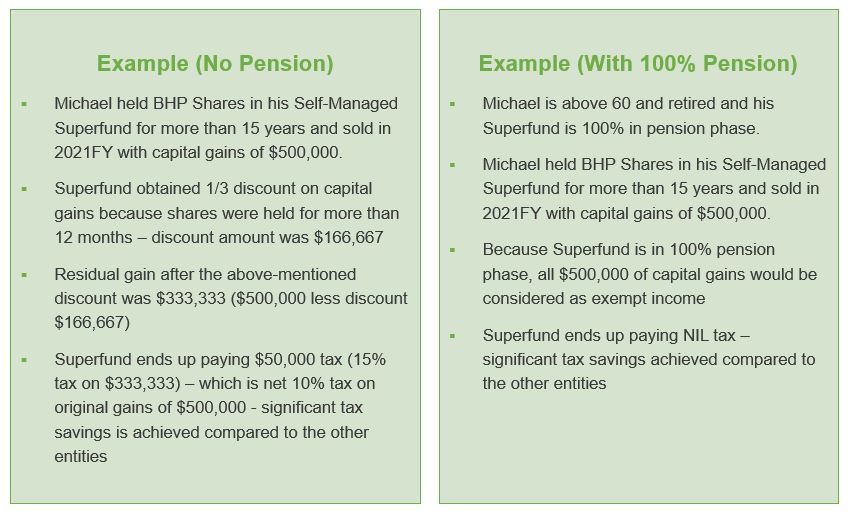

Capital Gains in Superannuation

When assets held by a super fund are sold for a profit, the capital gain is generally taxed at a concessional rate of 10% if the asset has been held for more than 12 months. For assets held for less than 12 months, the capital gain is taxed at 15%.

Please note that if the SMSF is in the pension phase (where members are drawing down on their super), any capital gains on assets supporting the pension are tax-free.

Key Considerations to Keep in Mind

These strategies require careful planning and consideration of your individual circumstances.

Before making superannuation contributions to save tax, there are several considerations to keep in mind:

- Contribution Caps: Be aware of the annual caps for concessional (before-tax) and non-concessional (after-tax) contributions.

- Member Balance: Depending on your member balance, you may not be able to make non-concessional contributions and/or carry forward unused concessional contributions.

- Tax Deductibility: Concessional contributions are generally tax-deductible, while non-concessional contributions are not. Consider the tax implications of each type of contribution.

- Superannuation Guarantee Contributions: Ensure that any additional contributions do not push you over the concessional contributions cap, which includes the superannuation guarantee contributions made by your employer.

- Age and Work Status: Contribution rules vary based on age and work status.

- Contribution Timing: Consider the timing of your contributions to ensure they are allocated to the correct financial year for tax purposes.

- Superannuation Fund Performance: Evaluate the performance of your superannuation fund and assess whether additional contributions will help you achieve your retirement savings goals.

- Impact on Government Benefits: Consider how additional contributions may impact your eligibility for government benefits, such as the Age Pension or other means-tested benefits.

- Tax Implications for Beneficiaries: Consider the tax implications for your beneficiaries in the event of your death, as superannuation benefits are subject to different tax treatment than other assets.

We recommend seeking professional advice to determine the best approach for your situation. Please speak to our financial advisors or SMSF specialists on 03 8419 9800 for more information prior to implementing any superannuation strategies.

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.

Wilson Pateras Accounting Pty Ltd is a related entity of Wilson Pateras Lending and Finance (VIC) Pty Ltd and Wilson Pateras Financial Planning Pty Ltd (Wilson Pateras Group). Where you are referred to a related entity by your adviser and take up lending or financial services, your adviser and the directors and shareholders of the Wilson Pateras Group do not receive any direct remuneration or benefit as a result of these referrals but may be entitled to profits as part of their ownership in each entity. You are free to engage your own preferred professional service providers should you prefer

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.