If you have your own SMSF, you can use it to invest in residential or commercial property as an investment, and even borrow money to do so. This is one of the key differences between the types of investments SMSFs can make compared to other types of super funds.

Benefits of buying SMSF property

The benefits of investing in property via your SMSF include:

- tax benefits

SMSF earnings (like investment property rental income) are taxed at the concessional rate of just 15%.Property expenses can be deducted from earnings, as can loan interest if you borrow to buy the property.

In addition, any capital gains made on an SMSF investment property held for longer than 12 months are taxed at just 10% ( a discount of 33% applies).

- rental income for loan repayments

You can use rental income for your repayments if you borrow funds to buy your SMSF investment property.

- capital growth over time

Australian property prices have a strong long-term growth trend, even though there are inevitably shorter-term periods when prices stagnate or decline.

How do I purchase property through my SMSF?

Firstly, you must ensure that your SMSF residential or commercial property purchase will comply with Australia’s superannuation regulations. Any SMSF investment property must pass the sole purpose test. In other words, it must be bought for the sole purpose of providing retirement benefits to fund members. No fund members are permitted to obtain any current benefits from the property that is bought.

For example, fund members (and their relatives) cannot live in an SMSF residential property or use it as a holiday house. The property also cannot be bought from or sold to another fund member (or one of their relatives).

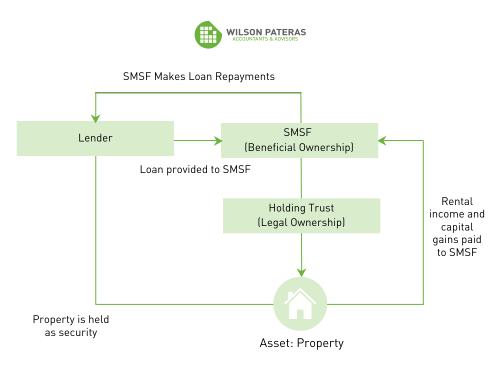

The SMSF must also be the legal owner of the property, not individual fund members. A separate trust (a holding trust) is set up for this ownership purpose. All financial transactions associated with the property must be conducted through the super fund.. For example, the receipt of tenant income and any property-related payments, including loan repayments. You can finance the SMSF property purchase using existing SMSF funds or taking out an SMSF property loan. See a chart below for an understanding of how the structure should be set up.

SMSF property loans

SMSF property loans must be set up as a limited recourse borrowing arrangement (LRBA) to comply with Australia’s superannuation legislation. An LRBA protects the other assets in an SMSF in the case of loan default. The lender only has recourse to the property bought under the arrangement to cover the outstanding debt, not to any of an SMSF’s other assets. An LRBA therefore protects SMSF members.

Not all lenders offer SMSF loans. Those that do will have different approval criteria. One criteria may be that your SMSF has a minimum balance above a certain threshold (e.g., $200,000).

The maximum loan-to-value ratio on SMSF loans is usually 80% for residential properties and 70% for commercial properties. In addition, because SMSF property loans are strictly investment property loans, interest rates are usually higher than residential home loans. The higher rate compensates the lender for the higher risk, especially if you are relying on tenant income for your SMSF loan repayments. There is always the possibility that your property may be untenanted for various periods of time over the term of the loan.

In today’s high interest rate environment borrowing power has decreased using income under personal names. Borrowing to buy a property under a self managed super fund can be a way of extending your ability to acquire property as an investment without affecting your own personal borrowing power.

How we can help

Our SMSF professionals at Wilson Pateras can help you to identify whether your SMSF meets the criteria to invest in property. Alternatively, if you do not have an SMSF and would like to set one up, our advisors can assist with the setup and future maintenance of the fund.

In addition, our lending and finance team can help you with a specialised SMSF property loan. Contact us on 03 8419 9800 today for more information.

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.

Wilson Pateras Accounting Pty Ltd is a related entity of Wilson Pateras Lending and Finance (VIC) Pty Ltd and Wilson Pateras Financial Planning Pty Ltd (Wilson Pateras Group). Where you are referred to a related entity by your adviser and take up lending or financial services, your adviser and the directors and shareholders of the Wilson Pateras Group do not receive any direct remuneration or benefit as a result of these referrals but may be entitled to profits as part of their ownership in each entity. You are free to engage your own preferred professional service providers should you prefer

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.