If you are a company director in Australia, then you have a legal obligation to ensure your company’s compliance with tax and superannuation legislation. This compliance is monitored and enforced by the Australian Taxation Office (ATO).

In addition, it is important to understand your personal liability as a company director. If your company cannot pay its pay as you go (PAYG) withholding tax, goods and services tax GST) and super guarantee charges on time, then as a director you can be held personally liable for any amounts owing which could potentially lead to bankruptcy. We have outlined more information regarding this below.

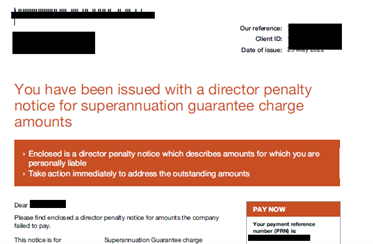

Warning letters from the ATO — Director Penalty Notices (DPNs)

If your company has unpaid tax or super obligations, then the ATO can issue you and any other company directors with DPNs.

There are two main types of DPNs:

- a 21-day DPN (example below)

This is where a company has submitted its business activity and superannuation guarantee statements within 3 months of them being due but has not paid the amounts owing.

- a lockdown DPN

This is where a company has failed to submit its business activity and superannuation guarantee statements within 3 months of them being due and has also not paid the amounts owing. It is important to understand that the ATO can issue DPNs due to tax returns not being submitted via estimating the amount owing.

Who can be issued with a DPN?

Both former and current company directors can be issued with a DPN for unpaid company tax and super. Resigning from being a company director does not eliminate your personal liability for any unpaid amounts during your term of being a director.

If you have been issued with a DPN, then the ATO then has the power to do any of the following to recover the amount owing:

- issue a garnishee notice

This is an order for any business or person who may owe your company or you either now or in the future to pay the amount owing to your company or you to the ATO instead until the amount owing on your DPN is fully repaid.

- offset any tax credit due to your company or you against the amount owing

This could affect either your company or your personal cash flow.

- initiate legal proceedings against you to recover the debt

Depending on the severity of the non-compliance, this could result in civil or criminal penalties. The only legitimate defence against liability for the debt is if you can prove that you took reasonable steps to ensure the company’s tax and super compliance obligations.

What to do if you receive a DPN

If you receive a DPN, you have 21 days to do one of the following:

- fully repay the outstanding amount.

- negotiate either a company or personal repayment plan.

- apply for the company to be placed in a form of administration.

You should get independent legal and professional accounting advice on your best course of action to settle the debt.

If the amount owing cannot be repaid, any of the following could happen to the company based on the provisions of the Corporations Act:

- an administrator being appointed to the company.

- the company being wound up.

- a restructuring practitioner being appointed to the company.

How we can help

Our tax professionals at Wilson Pateras can help our clients initiate or negotiate a payment plan with the ATO. We can also assist you to setup a business management plan for the debts and liabilities you have, to help prevent the reoccurrence of these types of proceedings in future.

If you need a business loan to help pay off ATO debt you may have, please contact Brett Elliot at Wilson Pateras for more information on 03 8419 9800.

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.