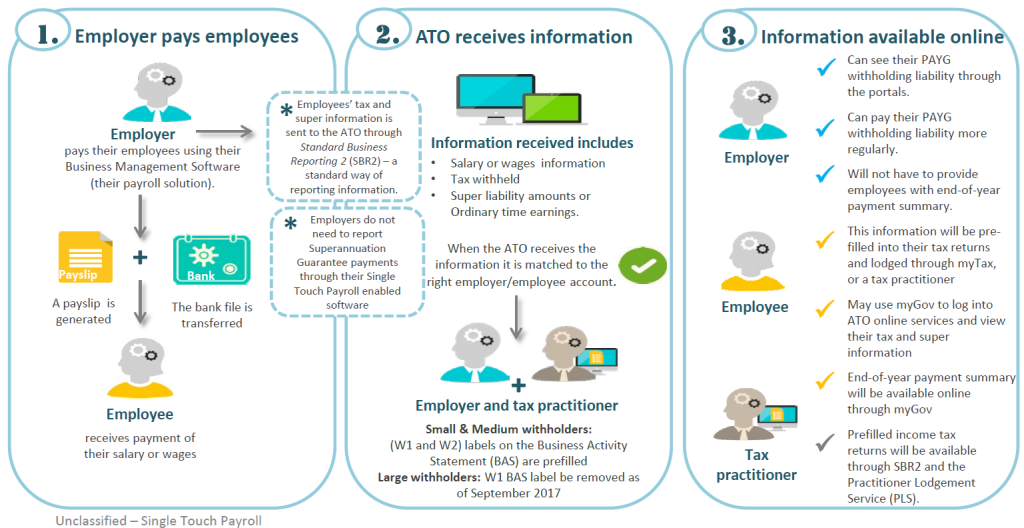

Single Touch Payroll is a government initiative to streamline business reporting obligations. When an employer pays their employees under Single Touch Payroll the information will be sent directly to the ATO at the time of the payroll.

Key features:

- Employers with 20 or more employees will be required to start reporting through Single Touch Payroll from 1 July 2018.

- To determine if they are required to report through Single Touch Payroll employers will need to do a Headcount of their employees on 1 April 2018.

- Employers will be required to report salary or wages, pay as you go (PAYG) withholding and superannuation information to the ATO when they pay their employees.

- Employers with 19 or fewer employees may elect to use Single Touch Payroll on a voluntary basis. It expected STP will become compulsory for these employers from 1 July 2019

Single Touch Payroll and Employers:

Direct payroll reporting

Single Touch Payroll will streamline business reporting obligations and make it easy for employers to report payroll and superannuation information electronically to the ATO. When employers complete their payrolls their employees salary or wages, PAYG withholding and superannuation information will be sent to the ATO.

Streamlined reporting

Single Touch Payroll will align employers reporting cycles with their normal business processes. Salary or wage information and PAYG withholding amounts reported though Single Touch Payroll will be pre-filled into the employers BAS. Employers or their tax practitioner will still be able to adjust information in their BAS.

Employee end-of-year pay information

Clients using Single Touch Payroll will not have to provide their employees with Payment Summaries at the end of the financial year. They also will not be required to provide the ATO with a Payment Summary Annual Report (PSAR). Employers will however need to notify the ATO when the Payment summary data is considered final.

Single Touch Payroll and Employees:

Online forms for new employees

Single Touch Payroll will enable new employees to complete TFN declaration and Superannuation Standard choice forms online and most information will be pre-filled and validated when they start new employment with a CloudPayroll client. This will reduce data entry and validation errors.

More information online

Employees will be able to access more timely tax and superannuation information online through ATO Online services in myGov. A secure myGov account lets individuals link a range of other services all in one place.

Year-to-date and end-of-year

Employees will be able to see their year-to-date salary and wages amounts, the tax that has been withheld and their superannuation entitlements through their ATO Online services in myGov 24/7.

How to report

You can report through Single Touch Payroll (STP) in one of the following ways:

- Report from your current payroll solution when it is STP-ready.

- Report from a new payroll solution which is STP-ready.

- Ask a third party, such as Wilson Pateras, to report through STP on your behalf.

How Wilson Pateras can assist

If you do not have a STP ready solution then Wilson Pateras can assist as follows;

- Help select and establish a payroll system for use using STP enabled technology such as Xero.

- Handle the transmission of data to the ATO on your behalf.

Contact us on 03 8419 9800 for more information