What’s Your Superannuation Strategy?

Many Australians are unsure how their super is working for them, how their lives will change when they retire, and whether an SMSF might suit their circumstances.

This article answers to following questions:

- Is superannuation still an important element in retirement planning?

- How to increase your super balance

- I am self-employed, should I be making super contributions

- How much superannuation is enough to retire on?

- How can superannuation be made to work harder?

- Industry vs Retail vs Self-managed Super Funds (SMSF)

- Who will most benefit from a self-managed super fund?

Read on as Lasadi helpfully unpacks the importance of superannuation when it comes to retirement planning and how to create a super, super strategy.

Is superannuation still an important element in retirement planning?

Absolutely. Superannuation allows you to begin saving for your retirement from the first day that you begin work. This means that you’re also planning for your retirement from the first day that you begin work. The mandatory employment contributions that are paid into your nominated superannuation fund each payday provides the perfect building block for your retirement plan. However, this figure alone is not a retirement plan in itself. There are many factors beyond super that can contribute to your retirement plan, these involve structuring your personal investments and structuring your income, in addition to structuring your super.

How to increase your super balance

With the automation of payroll, employees often neglect to think about putting a strategy behind their superannuation contributions. Supplementing employer contributions is the simplest way to increase your super. If you rely solely on your employer’s contribution, your super balance will not accumulate at the pace you may desire. Evaluating your income and considering whether you’re in a position to contribute from your personal cash flow is a simple step to take.

Another important factor of different superannuation strategies is to ensure your super is doing the best it can is to have it all in one place. Consolidating any super accounts that may have been created over the span of your career into one chosen account will ensure the greatest benefits for you. It will save on fees and reduce paperwork. You can do a lost super search to help you track down any lost or missing super and consolidate it into one super fund to bulk up your nest egg. Once your funds are combined, you can see more clearly whether you’re on track for retirement.

Some other ways to increase your super balance are:

- Ensure that your regular employee contributions are being made

- Make tax deductible personal contributions (before-tax or concessional contributions)

- Make personal contributions (after tax or non-concessional contributions)

- The low-income super tax offset

- Spouse contributions

- Look at your level of insurance through super

- Pay attention to your fees and premiums, these can add up over time and impact your balance.

I am self-employed, should I be making super contributions

Contributing regularly to super is especially crucial for self-employed professionals. Often, small business owners or entrepreneurs will prioritise their business financials over their personal wealth and typically overlook their superannuation. It is of the upmost importance for these professionals to take an active approach towards building their retirement assets.

If you are drawing a salary it is compulsory to pay yourself super, however, if you are paying yourself a director’s fee, you don’t necessarily have to. However, we recommend that you seek advice as you may be able to use super contributions as a tax minimisation strategy while building your wealth for retirement.

How much superannuation is enough to retire on?

In the DNA of today, there is no magic superannuation number. Your figure will depend on the kind of lifestyle you desire to lead once you leave work. If you want to travel often or enjoy fine dining or purchase expensive cars, this means your number will go up. Alternatively, you may have loved ones to support or passion projects to pursue, and these should be accounted for when considering your retirement planning.

ASFA now suggests that retired couples will now need $61,522 (net tax) per year to maintain that same ‘comfortable lifestyle’.

How can superannuation be made to work harder?

When implementing superannuation strategies, one of the best ways to make your super work harder for you is to have a higher risk tolerance. By taking more investment risks, you are more likely to enjoy a higher return. Before you do this, you should work out how much risk you can afford to take. Work with a financial advisor to identify your “risk tolerance”.

Other ways of getting your super to work harder is by:

- compounding your capital growth

- Reviewing your investment options every 6-12 months

- Build your super early which can make a big difference to how much you have when you retire

Industry vs Retail vs Self-managed Super Funds (SMSF)

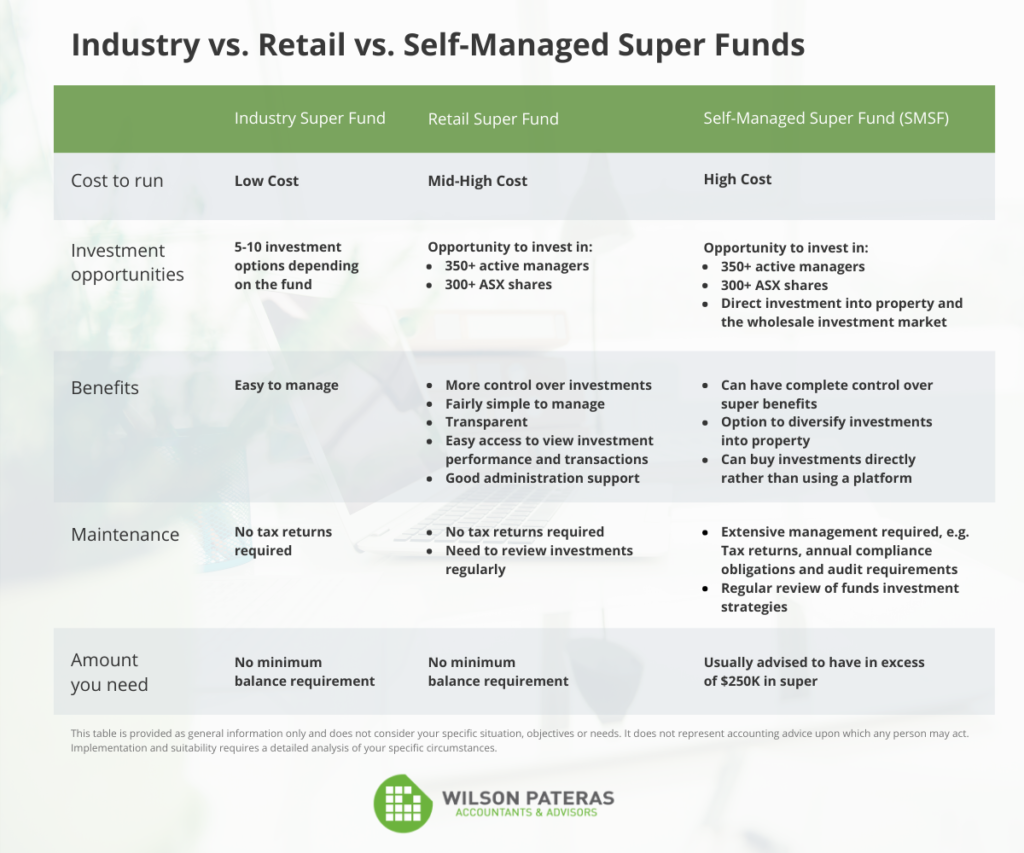

With an Industry Super Fund, you still have the option to choose where your money is invested, however it is quite limited in choice. The difference with a Retail Fund is that you typically have up to 350 active managers and access to the top 300+ ASX shares to invest in. This can help diversify your investments to maximise your retirement benefits. SMSF’s give you more control over your super benefits and the added opportunity to invest outside of shares, such as investing in direct property.

Who will most benefit from a self-managed super fund?

Anybody can set up a self-managed super fund – however a SMSF would be most beneficial to those with particular goals surrounding the management of their fund. Individuals who would like greater autonomy over their super, would like to include family members in their fund or pool their super rather than having two or three funds are best placed to consider a SMSF. If an individual is looking to diversify their investments or buy direct property, a SMSF may be an option. Wilson Pateras can assist in identifying if a SMSF is right for you and if it will achieve the best outcome in regard to your financial goals and investment objectives.

At Wilson Pateras, our experts are happy to sit down and assist our clients to plot out their lifestyle and goals. We will work with them to map out the steps necessary to achieve their ultimate retirement. If our clients are proactive and come to us well before they are ready to retire, we’ll have ample time to strategise. In such cases, we also have the ability to track life changes and tailor plans to meet our client’s career milestones. These reviews are ongoing and beneficial. If a client comes to us with a magic superannuation number in mind, we’ll do our very best to put strategies in place in order to achieve that vision.

Review Your Superannuation Strategy

Have further questions on superannuation strategies or would like to find out if SMSF is right for you? Wilson Pateras are here for you. Our experienced team will meet your super, tax, investment and finance needs so that you can focus on putting your plans in motion! Get in touch with our team at Wilson Pateras for your free consultation.

Learn more:

Retirement Planning

Self-Management Super Funds

Financial Planning