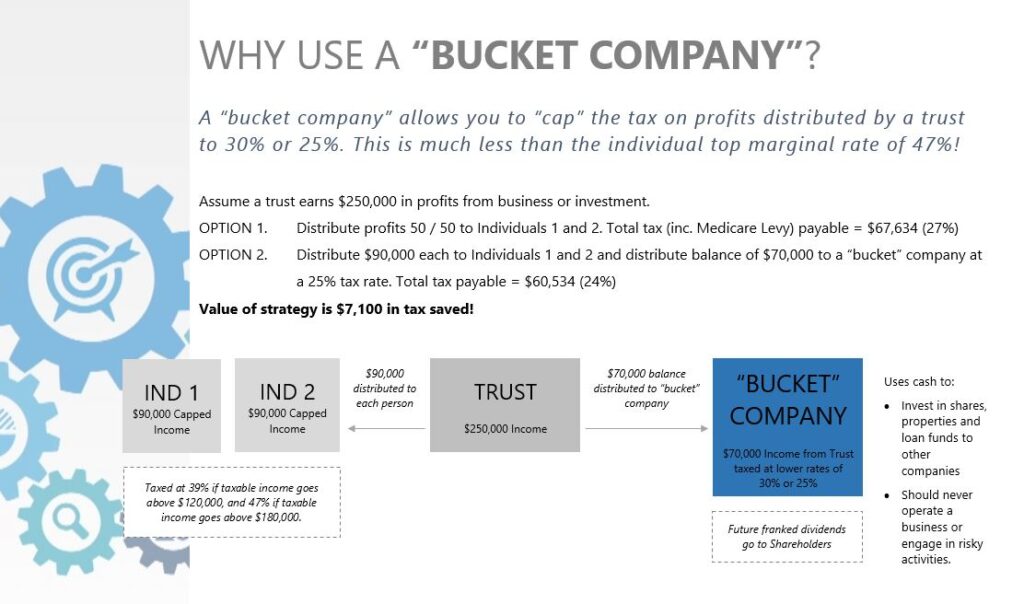

A “bucket company” can allow you to “cap” the tax on profits distributed by a trust to 30% or 25%. This is less than the individual top marginal rate of 47%! If you have a Discretionary or Family Trust that generates profits, then this strategy could benefit you. Below is an example of how a bucket company works:

Assume a trust earns $250,000 in profits from business.

Option 1: Distribute profits 50 / 50 to Individuals 1 and 2. Total tax (inc. Medicare Levy) payable = $66,734 (26.7%)

Option 2: Distribute $90,000 each to Individuals 1 & 2 and distribute balance of $70,000 to a “bucket” company at a 25% tax rate. Total tax payable = $60,534 (24%). (Note: This strategy assumes that the $70,000 in cash is available to be distributed to a bucket company, otherwise what is known as a Div 7A Loan Agreement will need to be entered into and loan repayments made over a 7-year period.)

The VALUE of this strategy is $7,100 in TAX SAVED!

The cash in a “bucket company” could be used to invest in shares, property, or to lend to other entities at a specific interest rate.

Important: You should discuss this with your accountant and financial advisor prior to using this strategy. There are different tax laws that affect the use of this strategy, and whether your “bucket company” can use a tax rate of 30% or 25%.

As your Accountants, we are aware of these tax laws and can assist you. Please contact us to book your tax planning consultation on 03 8419 9800.

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.