Small Business Specialist Advice Pathways Program

The Victorian State Government has launched a $2,000 grant that small businesses can use to pay for professional advice from accountants, bookkeepers or lawyers. The grant, called the Specialist Advice Pathways Program is designed to help small businesses meet the costs of seeking advice to assist them to make the best possible decisions about their business. Please […]

A Guide To Minimising Your Business Tax (2020)

Edit: This blog post is updated on 17 March 2020 Looking to minimise your business tax? Here’s a guide to the strategies you can use. Tax minimisation for small businesses Is Your Business A ‘Small Business” Entity? Small businesses can access a range of tax concessions from the ATO. To qualify as a “Small Business […]

EOFY Checklist 2019 – End of Financial Year Important Dates + Tips For Businesses

Another financial year has finished! As a business owner, there are many obligations that you need to consider and action just after 30 June. Some of these will help to minimise your tax. Others will reduce your exposure to an ATO tax audit. We have outlined these action points below to assist you. Please carefully […]

City of Melbourne Small Business Grant

Supporting small business to take the next step: Up to $30,000 is available to help innovative small businesses located in Melbourne to start-up and grow. Applications are now open and close 6 August 2018. Helping passionate, innovative small businesses realise their dreams and reach new markets is the primary aim of our small business grants program. The program […]

The Most Common Small Business Mistakes and How You Can Avoid Them

Has your small business been hit with a cash flow curveball, experienced a recent budget blowout or had the ATO making enquiries? Whilst the Wilson Pateras team hope that this isn’t the case, we understand that in small business mistakes can happen – and they sometimes have costly repercussions. Our advice? Avoid them all […]

Accounting for Entrepreneurs

It’s common for entrepreneurs and small business owners to feel uncertain about engaging an accountant in the early stages of their business. Rather than spend on professional services, they will attempt to manage their own accounting responsibilities in an effort to save resources. Whilst being thrifty make sense when you’re testing a new business model, […]

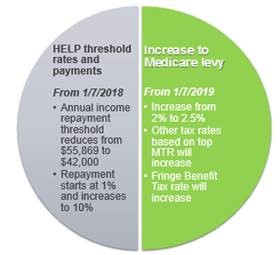

2017 Federal Budget

First home savers, downsizers and small business are winners in Treasurer Scott Morrison’s second Budget – while taxpayers face an increase in the Medicare levy. It’s been a relatively quiet year given last year’s substantial Superannuation changes. However, there are some measures in the 2017 Federal Budget that could have an effect on many […]